According to a recent CareerBuilder study a shocking number of Americans are living pay check to pay check. In fact, income levels you would think are high enough to support savings aren’t, this could imply a significant decay in the standard of living. As a Financial Advisor I have seen this up close and personal in and around Charlotte. Based on my own personal view, in and around Charlotte, Food & Housing are the largest components of most people’s budgets who are close to cash flow neutral. Both home prices and rents have been rising over 5% in the Charlotte are well above the national wage growth rates, which have barely budged over the last 10 years.

According to the Bureau of Labor Statistics, NC personal income grew just 1.2% year over year. So it’s no wonder individuals are falling behind. Part of the financial planning process entails living expense itemization and calculating your current cash flow then figuring out ways to free up cash flow to save. According to the study 9% of workers surveyed making $100,000 or more say usually or always live pay check to pay check and an astounding 59% are in debt.

For those making $50,000-$99,999 28% usually or always live pay check to pay check and 70% are in debt. For those making under $50,000, over half usually or always live pay check to pay check and 73% are in debt. Debt isn’t necessarily a bad thing unless you find yourself in a position you don’t have the cash flow to make principal payments and fall further behind. Restructuring debt and creating a plan to reduce debt are key methods of improving cash flow to allow you to save more. Going back to the study, 56% feel they will always be in debt and 38% don’t participate in a retirement plan. The lesson learned is the longer you procrastinate, the longer it will take to save the amount of money you need for your stated goals and objectives.

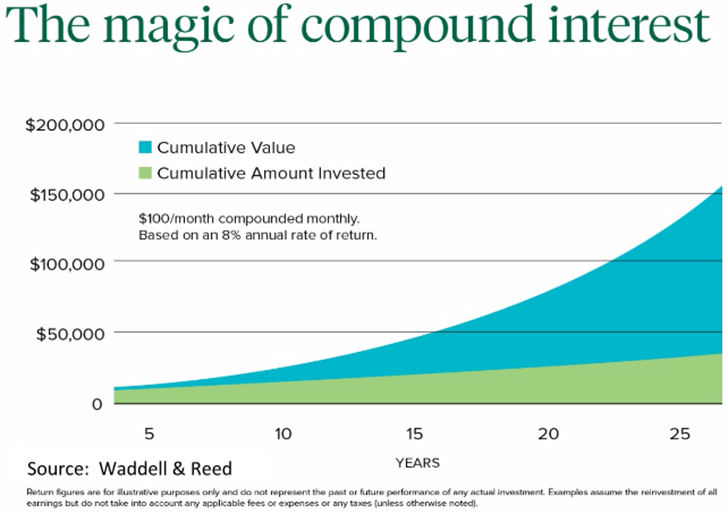

The following chart illustrates this as over long periods of time it is actually the compounding of interest, not the amount you contribute, that accounts for most of the value you accumulate. This shows if you don’t start savings early, you risk having to save more later. Given the study just discussed, that is becoming harder and harder to do. As a reminder for those in debt, the era of low or zero interest rates appears to be over. That maybe why debt levels are so high for Americans, as central banks encourage the use to debt to grow the economy.