Introduction

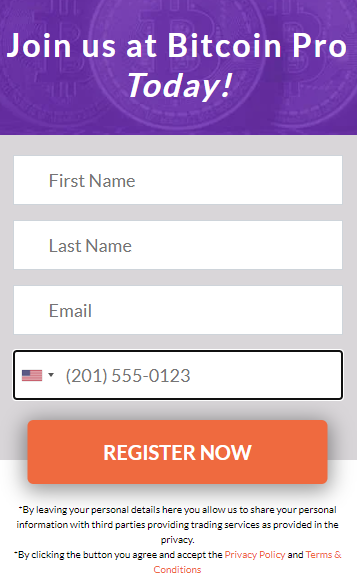

The world of today is facing a severe financial crisis; as a result, perpetually, customers are jumping aboard the digital currency fad, including Bitcoin, Litecoin, and essentially all cryptos for relief, making news day by day. They’re achieving it with the assistance of a commercial bitcoin center. An advanced cash commercial center is tantamount to an exchanging stage, yet it focuses on computerized money rather than stock arrangements. Customers who buy and exchange digital currencies products could trade computerized cash in worth relying upon present market esteems on a bitcoin’s trade’s commercial center. Regularly, the trades framework empowers activities or trades in either provincial paper cash to Bitcoin installment tasks or crypto to Crypto installment activities. Some digital currency trades need to give a primary stage to clients, while others desire to give cutthroat estimating and a stage for experienced cryptographic money brokers. Check the image below to start your bitcoin journey.

The world of today is facing a severe financial crisis; as a result, perpetually, customers are jumping aboard the digital currency fad, including Bitcoin, Litecoin, and essentially all cryptos for relief, making news day by day. They’re achieving it with the assistance of a commercial bitcoin center. An advanced cash commercial center is tantamount to an exchanging stage, yet it focuses on computerized money rather than stock arrangements. Customers who buy and exchange digital currencies products could trade computerized cash in worth relying upon present market esteems on a bitcoin’s trade’s commercial center. Regularly, the trades framework empowers activities or trades in either provincial paper cash to Bitcoin installment tasks or crypto to Crypto installment activities. Some digital currency trades need to give a primary stage to clients, while others desire to give cutthroat estimating and a stage for experienced cryptographic money brokers. Check the image below to start your bitcoin journey.

Benefits of Crypto Exchanges

The necessary arrangement is easy. Everyone spends to amplify their benefits, regardless of whether they are a purchaser or corporate brokers. Proficient financial backers with openness to institutional-grade managing capacities ought to take part in an industry that requests an complete KYC system, has the genuine negative press and has solid security breaks to start with.

How to Earn Money through Crypto Exchanges?

A crypto exchanging industry is an area where clients could trade advanced cash. Explicit digital money commercial centers give different products and exercises, though others are exclusively devoted to the buy and offer of virtual monetary standards. Financial backers and sellers are coordinated on digital money commercial centers. To buy and exchange on most digital currency stages, you should initially enlist, similarly as you would with a standard monetary establishment account. Your record will be made after you have finished the KYC system and been approved, and you will actually want to move cash (paper cash or electronic cash) into the commercial center, which you may then use to finish exchanges.

Types of Crypto Exchanges

When picking which commercial center to use, it’s great to contemplate your monetary destinations and affectability for the possibility.

Brokers

Traditional merchants could work as go-betweens among the crypto commercial centers and clients who need to buy and exchange virtual monetary standards. These aren’t, by the by, genuine bitcoin sellers. Anybody may visit an online business and procure cryptographic money at the foreordained valuing set by the intermediary. While setting an outstanding buy or exchange, an over-the-counter business is typically utilized. While building up an exchange market, installments move on an organization; this forestalls the capability of the flood.

Customary Crypto Exchanges

These organizations make it simpler to secure and exchange electronic items utilizing current commercial center estimating. They often demand preparing charges. Explicit commercial centers just exchange digital forms of money, while others let buyers exchange paper cash for Bitcoins. Brought together trades and decentralized trades are the two fundamental sorts of commercial centers.

An exchange overseer supervises a concentrated crypto commercial center, guaranteeing that buyers make a record and exchange happen effectively. These organizations make it helpful to buy digital currencies with your monetary establishment record or banks’ installments cards. By and by, notwithstanding the item obtaining, this comfort of availability regularly goes with expenses for the commercial center administrator. Merchants can buy and exchange electronic wares with fiat cash and other cryptos on different controlled stages.

Blockchain innovation and digital currencies were made to accept that a brought together influence should not direct the exchange and utilization of cash. A decentralized cryptographic money commercial center that works without the association of an outer element is open-source programming and depends on individual to individual exchanges. Then again, decentralized commercial centers regularly require more brilliant particular aptitude and top to bottom comprehension of cryptographic money than brought together commercial centers.

A few of the vast difficulties with commercial decentralized centers is liquidity. By and by, there are inadequate commercial center makers on decentralization commercial centers to create an adequate number of purchasers, bringing about an absence of liquidity to adapt to concentrated commercial centers.

Dangers Associated

There is likewise no helpline to contact in the event that you get caught, no organization workplaces to contact on the off chance that you squander your resources, and consequently no FDIC-guaranteed monetary establishments to help these resources, which implies you might chance the entirety of your cash quickly to cybercriminals with no review.