The proposed GOP House plan is most likely a win/win proposition for the local Charlotte housing market. First let us understand the broad provisions of the bill before accessing the impact on the housing market. There are three key provision that will directly impact the housing are market:

The proposed GOP House plan is most likely a win/win proposition for the local Charlotte housing market. First let us understand the broad provisions of the bill before accessing the impact on the housing market. There are three key provision that will directly impact the housing are market:

1. Lower Tax Rates: The lowering of both corporate and income tax rates will most likely cause higher GDP growth in an already tight labor market. Over-time higher growth will likely drive wages higher which has been lacking this entire housing recovery cycle. Wages are an important factor in making houses more affordable, driving demand and thus price appreciation.

2. Elimination of Mortgage Interest Deduction: The second factor in the proposed legislation is the elimination of the mortgage interest deduction. This will effectively reduce incomes making houses less affordable by increasing the effective tax rate of those who maintain mortgages.

3. Cap the Deductibility of Real Estate Taxes to $10,000 while eliminating the deduction of state & local taxes: The third piece of the proposed legislation impacts the deductibility of state & local taxes. Currently there isn’t a cap on either property tax and state & local taxes can be deducted. This again will effectively increase the effective tax particularly for those in the higher tax states in the Northeast and West Coast.

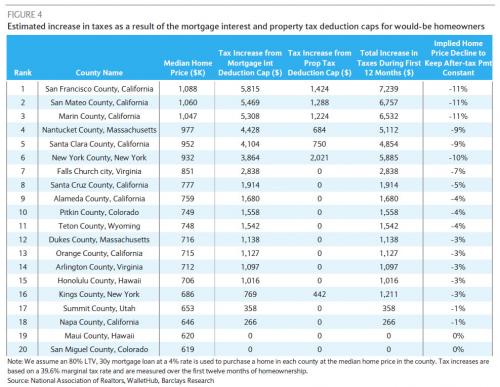

The table below shows the tax impacts of #2 & #3 on the top 20 regions ranked by highest real-estate values. Essentially the elimination of the above housing related deductions will decrease incomes (Total Deduction Change Amount * (1-Effective Tax)). As the chart below shows if you live in Kings County in New York City and had a house valued at $686,000 your tax impact is over $1,600. Roughly speaking this could be scaled up as more expensive homes are disproportionally impacted. As home value doubles so will the tax impact and a $1.3 million house (which many homes are especially in NJ & Long Island) it would be $3,200. It safe to say in most suburban areas in the NE surrounding major metros you can expect to pay a few thousand more in taxes if one just analyzes these deductions in isolation. Consult your tax professional to get more precise figures as other changes may reduce these impacts.

What’s important is that one of the drivers to Charlotte’s success real-estate wise is the exodus from the high tax states especially in the North East. The proposed legislation no doubt will negatively impact North Carolina residents (most higher priced homes), but much less so vs higher taxed states thus making the state & Charlotte EVEN MORE attractive to relocate to in my view. Further it may also as the chart below shows reduce the value of real-estate in areas most impacted as well.

Considering Buying a New Home? Please follow us on Linkedin by searching “Charlotte Consultant Services” for more insight on housing.

Considering Buying a New Home? Please follow us on Linkedin by searching “Charlotte Consultant Services” for more insight on housing.

We provide contract review consulting services for new construction clientele. For small business owners, we provide business planning consulting services.

Please contact us for further detail or complimentary consultation.