The latest rental competitivity report has just been released, pinpointing America’s toughest markets for apartment seekers during the peak rental season. It analyzes 139 U.S. markets by using five relevant metrics: occupancy rates, the number of renters applying for an available unit, the number of days apartments stayed vacant, the percentage of renewed leases and the share of new apartments.

The latest rental competitivity report has just been released, pinpointing America’s toughest markets for apartment seekers during the peak rental season. It analyzes 139 U.S. markets by using five relevant metrics: occupancy rates, the number of renters applying for an available unit, the number of days apartments stayed vacant, the percentage of renewed leases and the share of new apartments.

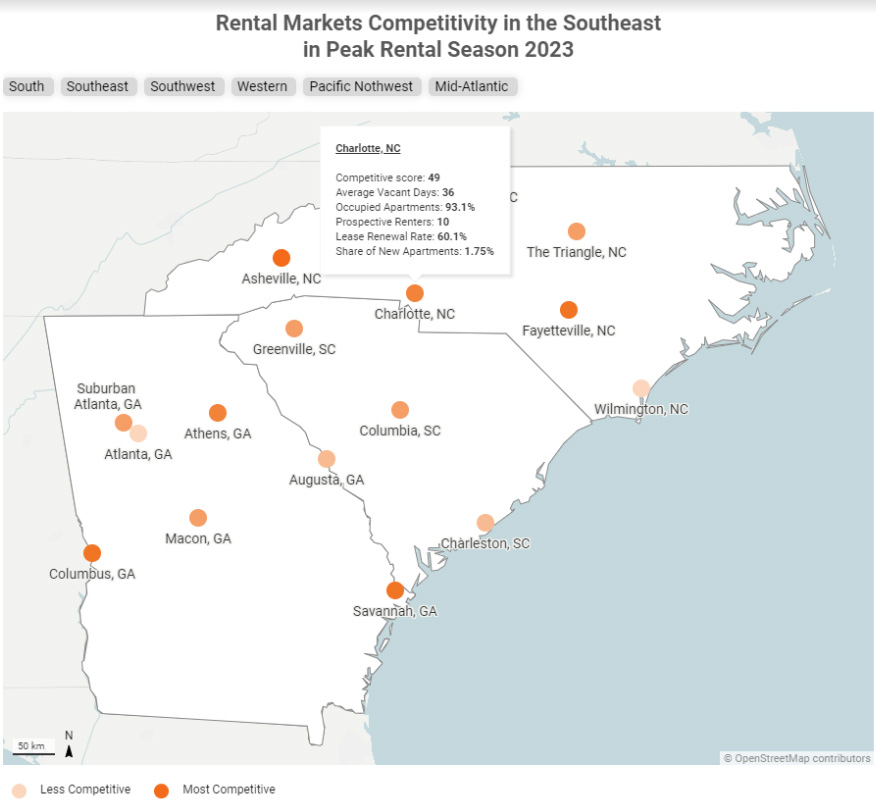

Charlotte remained one of the most competitive markets in the Southeast — but it didn’t rank among the nation’s hottest renting spots, mainly because of the significant increase in Charlotte’s apartment construction, that slowed down the market during peak season. At the same time, finding a rental here was slightly easier this summer than one year prior, with fewer renters competing for each vacant unit and a lower share of lease renewals.

Here’s a snapshot of Charlotte’s rental competitivity in peak rental season 2023:

- 10 prospective renters competed for each vacant unit in the area, with apartments getting snatched in 36 days — 1 day faster than the national average.

- Meanwhile, 60.1% of renters decided to renew their leases – almost on par with the national average of 60.5% – keeping the occupancy rate at 93.1%.

- Still, Charlotte saw a solid 1.75% increase in recently built apartments, which means renters had more options to choose from this summer. In fact, Charlotte is on track to become the nation’s 11th largest builder in 2023.

- As a result, Charlotte earned a Rental Competitivity Index (RCI) score of 49 for the peak rental season — by comparison, the national RCI score was 60.

- What about last year’s peak rental season? Despite a solid increase in new apartments (0.91%), vacant units became occupied faster during the moving frenzy of 2022 (32 days), with 15 renters competing for each apartment. More so, 64% of renters chose to stay put, which pushed the occupancy rate to a high 95%.