In the first quarter of the year, construction activity remained low due to ongoing oversupply, while rents increased in 29 of the 30 major markets we analyzed. The industrial real estate sector remains stable, though upcoming policy changes in global logistics and manufacturing could introduce new challenges.

In the first quarter of the year, construction activity remained low due to ongoing oversupply, while rents increased in 29 of the 30 major markets we analyzed. The industrial real estate sector remains stable, though upcoming policy changes in global logistics and manufacturing could introduce new challenges.

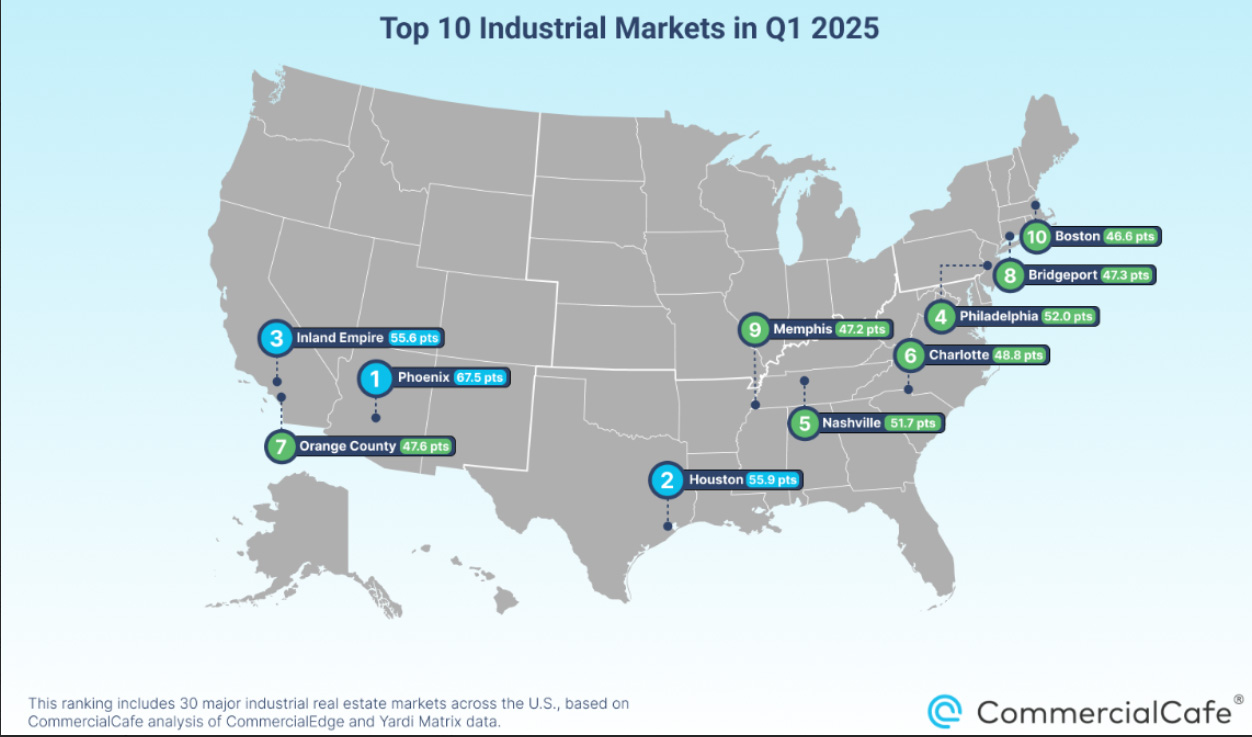

In an effort to capture the current trajectory of this sector, we ranked the country’s top industrial markets in Q1 2025 after analyzing them based on key indicators — vacancy rates, development pipelines, rental trends and loan maturities — using commercial real estate data and research from CommercialEdge and Yardi Matrix, as well as analysis of Google search trends.

Here are some of the key highlights:

Charlotte earned a total of 48.8 points in Q1 2025, ranking it as the 6th-best industrial market in our study.

- Charlotte delivered 2.9 million square feet of space in Q1, surpassing its follow-up, Los Angeles, by roughly half a million square feet. These deliveries brought along a 1% expansion of industrial inventory in Charlotte, the market placing 3rd for this metric.

- An additional 5.3 million square feet is currently under construction, representing a projected 1.6% increase of existing inventory.

- Charlotte also saw online interest in industrial space growing, with the average monthly search volume for industrial real estate keywords increasing by roughly 45% over the last 12 months in the market.

- The market has also benefited from growing search interest for industrial space at a state level, with the average monthly search volume for these keywords jumping 18% year-over-year.